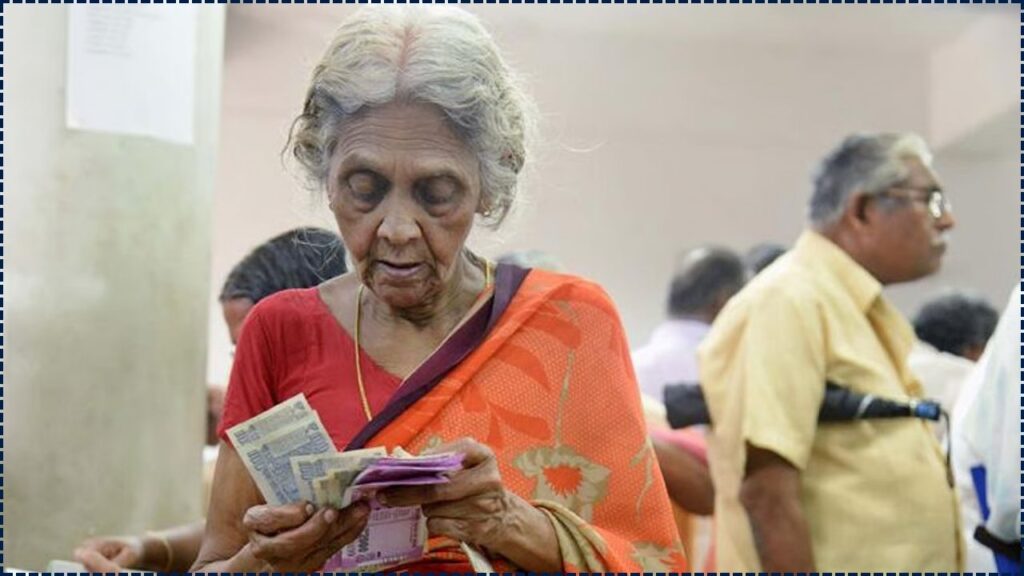

India’s online application process for the Widow Pension Scheme represents a compassionate milestone in extending social security through digital governance, offering vital financial support to widows, particularly those from marginalized and rural communities, with streamlined procedures and direct payments that uphold their dignity and provide hope in times of vulnerability.

By simplifying access to this crucial lifeline, the scheme fosters inclusion and empowerment, ensuring widows can navigate their challenges with greater ease and security. While awareness and access gaps persist in rural areas, addressing these challenges reflects a shared commitment among authorities, communities, and advocates to create an equitable, supportive system that nurtures resilience and builds a brighter, more inclusive future for every widow across India.

The Widow Pension Scheme provides financial assistance to economically vulnerable widows across India. Eligible women can now apply for the scheme through online government portals, reducing paperwork and improving access. The initiative is part of India’s broader effort to deliver social security benefits directly through digital platforms.

What Is the Widow Pension Scheme?

The primary central programme, the Indira Gandhi National Widow Pension Scheme (IGNWPS), operates under the National Social Assistance Programme (NSAP). It offers a monthly pension of ₹300 to widows aged between 40 and 79 from Below Poverty Line (BPL) households. Women aged 80 and above may receive ₹500 monthly.

Several states supplement this with additional pension amounts or separate welfare schemes. For example, Kerala channels pensions through local self-government institutions, while Maharashtra provides higher payments by combining IGNWPS with state-funded support.

Eligibility Criteria For Widow Pension Scheme

While requirements differ across states, common eligibility factors include:

- Age: 40–79 years under IGNWPS; some states extend this range.

- Marital Status: Must be a widow and not remarried.

- Income Level: Household must be classified as BPL or below state-defined thresholds.

- Other Benefits: Applicants already receiving pensions under other schemes may not qualify.

According to the Ministry of Rural Development, eligibility checks ensure benefits reach the intended groups without duplication.

Required Documents

Applicants typically need to submit:

- Husband’s death certificate.

- Proof of identity (Aadhaar card, Voter ID, or similar).

- Proof of residence.

- Age certificate or school records.

- Bank account details for Direct Benefit Transfer (DBT).

- BPL certificate or income certificate, if applicable.

Online Application Process For Widow Pension Scheme

Access the Official Portal

Visit the NSAP website for central scheme details, or your state government’s social welfare portal for state-level schemes.

Register or Log In

If online services are available, create an account using Aadhaar and mobile number. Many states also allow log-in through Common Service Centres (CSCs).

Complete the Application Form

Fill in personal details, income information, and bank account details. Upload scanned copies of required documents.

Submit and Verify

Submit the application online or at a CSC. Authorities will conduct document and field verification, sometimes through local Panchayat officials.

Pension Sanction and Payment

Once approved, the pension is credited monthly via DBT to the applicant’s registered bank account. Applicants can track the status of their application online in states with tracking facilities.

Related Links

How to Verify Property Documents Online Using State Portals

Applying for a Marriage Certificate Online: Step-by-Step Guide

State-Level Variations

- Kerala: Administers widow pensions through gram panchayats and municipalities, with income verification at the local level.

- Maharashtra: Provides higher combined assistance by supplementing IGNWPS with the Sanjay Gandhi Niradhar Anudan Yojana.

- Assam: Allows applications through the Panchayat and Rural Development Department portal, with BPL certification required.

Dr. Renu Gupta, a social policy expert at Jawaharlal Nehru University, noted: “The decentralised approach allows states to tailor schemes to local needs, but it also creates variation in benefits and eligibility that applicants must carefully navigate.”

Challenges and Digital Inclusion

While online applications improve accessibility, digital literacy and internet connectivity remain barriers. According to the National Sample Survey Office (NSSO), rural women face limited access to smartphones and reliable internet. The government has encouraged the use of CSCs to bridge this digital divide.