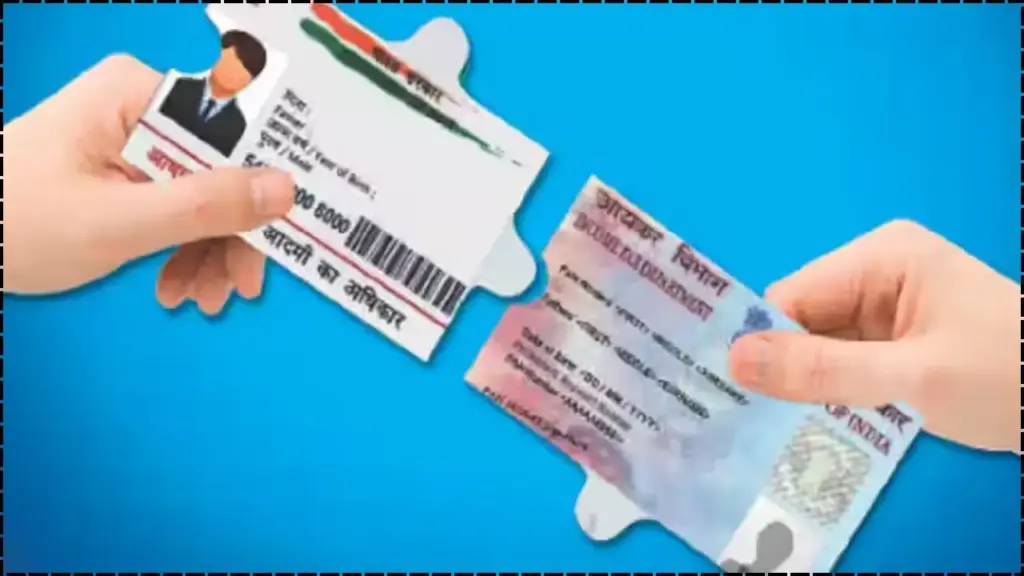

In India, the government has made it mandatory for all individuals holding both Aadhaar and PAN (Permanent Account Number) cards to link the two documents. This process is essential for the proper functioning of the country’s financial system.

As of 2025, failure to link Aadhaar with PAN will render your PAN card inoperative, which could lead to complications in financial transactions and tax filings. This article offers a detailed, step-by-step guide to help you complete this linking process efficiently.

Linking Aadhaar with PAN in 2025 is crucial to maintaining an active tax identification status in India. By following this simple, step-by-step guide, you can ensure that your PAN remains operative, allowing you to comply with tax regulations, access financial services, and avoid penalties. Remember, timely linking is essential for uninterrupted financial activities, so complete this process as soon as possible.

Table of Contents

Why is Aadhaar-PAN Linking Mandatory?

The Indian government’s initiative to link Aadhaar with PAN is part of its broader effort to streamline tax filings and curb financial fraud. By linking the two, the government aims to:

- Ensure accurate taxpayer records: Reducing the risk of duplicate PAN cards and ensuring that the tax records are clear.

- Combat tax evasion: Helping track individuals who may be using multiple identities or evading taxes.

- Enable easier financial transactions: Linking Aadhaar with PAN simplifies various transactions, including the filing of income tax returns, applying for loans, and conducting high-value transactions.

Without linking these two critical documents, taxpayers will face an inability to file taxes, leading to penalties, delayed refunds, and possible legal issues.

Guide to Link Aadhaar with PAN Card in 2025

- Visit the Official Income Tax e-Filing Portal: The Income Tax e-Filing portal is the primary platform for linking Aadhaar with PAN. Here’s how to access it:

- URL: https://www.incometax.gov.in

- On the homepage, find the ‘Link Aadhaar’ option in the ‘Quick Links’ section.

- Provide Required Information: You’ll be prompted to enter the following details:

- PAN Number: Your 10-digit PAN card number.

- Aadhaar Number: Your 12-digit Aadhaar number issued by UIDAI.

- Name as per Aadhaar: The name should exactly match what is printed on your Aadhaar card.

- Date of Birth: The date of birth registered in your Aadhaar.

- If any information does not match, you will not be able to link your Aadhaar and PAN successfully. Ensure that all the details are accurate.

- Validate Your Details: Once you’ve entered the required details, click on the ‘Validate’ button. The system will verify if the provided details match those in the UIDAI database. If they do, you’ll be prompted to continue the process.

- OTP Verification:

- Once the details are validated, an OTP (One-Time Password) will be sent to the mobile number registered with Aadhaar.

- Enter the OTP in the designated field and click ‘Submit’.

- This ensures that only the person whose Aadhaar and PAN are linked is completing the process.

- Confirm Your Aadhaar-PAN Linking: After successfully verifying the OTP, a confirmation message will appear on the screen, notifying you that your Aadhaar and PAN have been successfully linked.

You can save or take a screenshot of this confirmation for future reference.

What to Do if You Missed the Deadline?

If you missed the deadline for linking your Aadhaar with PAN, don’t worry—you can still link them by paying a penalty. The government charges a fee of ₹1,000 for late linking.

Pay the Penalty:

- Go to the e-Pay Tax Portal: Visit the e-Filing portal and click on ‘e-Pay Tax’ under the Quick Links section.

- Enter Your PAN Details: Provide your PAN and select the relevant options.

- Select Payment Type: Choose ‘Other Receipts (500)’ from the payment type options, and select ‘Fee for delay in linking PAN with Aadhaar’.

- Complete Payment: After selecting the payment mode, complete the payment using net banking, debit/credit cards, or other available methods.

- Link Your Aadhaar and PAN: After the penalty payment, revisit the Aadhaar link page, enter your details, and complete the linking process.

Check the Status of Aadhaar-PAN Linking?

To verify whether your Aadhaar is linked with your PAN, follow these steps:

- Visit the e-Filing Portal: Go to https://www.incometax.gov.in.

- Click on ‘Link Aadhaar Status’: This link is available under the Quick Links section.

- Enter PAN and Aadhaar Numbers: Provide your PAN and Aadhaar numbers and click on ‘View Link Aadhaar Status’.

- Check the Status: If the Aadhaar and PAN are linked, you will see a confirmation. If not, the portal will prompt you to complete the linking process.

Exemptions and Special Cases

Certain individuals and groups are exempt from linking Aadhaar with PAN:

- Residents of Assam, Jammu & Kashmir, and Meghalaya: These residents are exempt from the requirement to link Aadhaar and PAN.

- Senior Citizens: Individuals aged 80 years or more are exempt if they do not file taxes.

- Non-Residents: Non-resident Indians (NRIs) are also exempt unless they have lived in India for more than 182 days in the preceding 12 months.

Additionally, individuals whose names on Aadhaar and PAN do not match will need to update their details before linking. These discrepancies are common and can be rectified through the UIDAI portal or the Income Tax website.

Related Links

Central Government Announces New Monthly Assistance Scheme for Citizens — Check Eligibility Details

Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA): New Upgrades in 2025

Consequences of Not Linking Aadhaar and PAN

Failure to link Aadhaar with PAN will lead to severe consequences:

- Inactive PAN: Your PAN card will become inactive, which will affect your ability to file income tax returns, open bank accounts, and make large purchases.

- Penalties: Non-compliance could lead to additional penalties, and you will not be eligible for income tax refunds.

It is essential to link your Aadhaar with PAN as soon as possible to avoid these consequences.

Additional Insights:

- PAN and Aadhaar Linking for Businesses: For businesses, this linking is mandatory to ensure smooth tax filing. If business PANs are not linked to Aadhaar, they will face issues with filing returns and receiving GST refunds.

- Future of Digital Identity in India: The government’s push for Aadhaar-PAN linking is part of a larger movement towards digital identification, which aims to create an integrated system of public services. This will lead to better governance, easier access to services, and more efficient tax collection systems.

- International Comparisons: Many countries have similar systems in place to ensure the efficient use of personal data for tax and financial transactions. Aadhaar-PAN linkage in India is an attempt to digitize and modernize the financial system, similar to global efforts in countries like the US, UK, and Canada.