The online PAN card application process reflects India’s push toward digital governance. With Aadhaar integration, instant issuance options, and reduced paperwork, citizens can obtain this critical identity document with greater efficiency and transparency.

India’s PAN card online application system, through its seamless integration with Aadhaar verification and digital services, reflects a compassionate commitment to simplifying identity management, reducing bureaucratic hurdles, and empowering every citizen and resident with swift access to an essential financial document that unlocks economic opportunities.

By streamlining processes and minimizing paperwork, this initiative enhances efficiency and fosters inclusion, particularly for underserved communities, ensuring they can participate fully in India’s financial ecosystem with dignity.

Applying for a PAN card online in India has become a straightforward process through government-approved portals. Citizens and residents can apply digitally, using Aadhaar-based verification or by submitting scanned documents, reducing delays and paperwork traditionally associated with the process.

Table of Contents

Understanding PAN

The Permanent Account Number (PAN) is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for filing income tax returns, conducting financial transactions above a prescribed threshold, and opening bank accounts. According to the Income Tax Department, over 650 million PAN cards have been issued as of 2023.

Choose the Correct Application Platform

Applicants can register online using:

- Protean eGov Technologies (formerly NSDL e-Gov)

- UTI Infrastructure Technology and Services Limited (UTIITSL)

- The Income Tax e-Filing portal, which offers Instant e-PAN for Aadhaar-linked individuals.

Select the Correct Form

- Form 49A: For Indian citizens, including minors.

- Form 49AA: For foreign nationals and non-resident Indians (NRIs).

This distinction is vital, as an incorrect form leads to application rejection.

Fill Out the Online Application

Applicants must enter accurate personal details, including name, address, and date of birth. Required documents include:

- Proof of Identity (Aadhaar, Voter ID, Passport)

- Proof of Address (Utility bill, Driving licence)

- Date of Birth certificate

- Recent passport-size photograph

For Instant e-PAN, Aadhaar authentication replaces the need for additional documentation.

Payment of Fees

The application fee depends on the applicant’s address:

- ₹93 (plus GST) for Indian communication address.

- ₹864 (plus GST) for foreign communication address.

Payments can be made via debit/credit card, net banking, or demand draft.

Verification Process

Aadhaar e-Sign

Most applicants prefer Aadhaar-based e-sign, which uses a one-time password (OTP) sent to the Aadhaar-linked mobile number.

Physical Submission

Alternatively, applicants can print the acknowledgement form, attach required documents, and send it to the NSDL or UTIITSL processing centre within 15 days.

Related Links

Mapping Development: An Analysis of Indian State Performance Using NDAP Data

How to Register to Vote Online for Indian Elections

Applying for a New Passport in India: A Complete Walkthrough

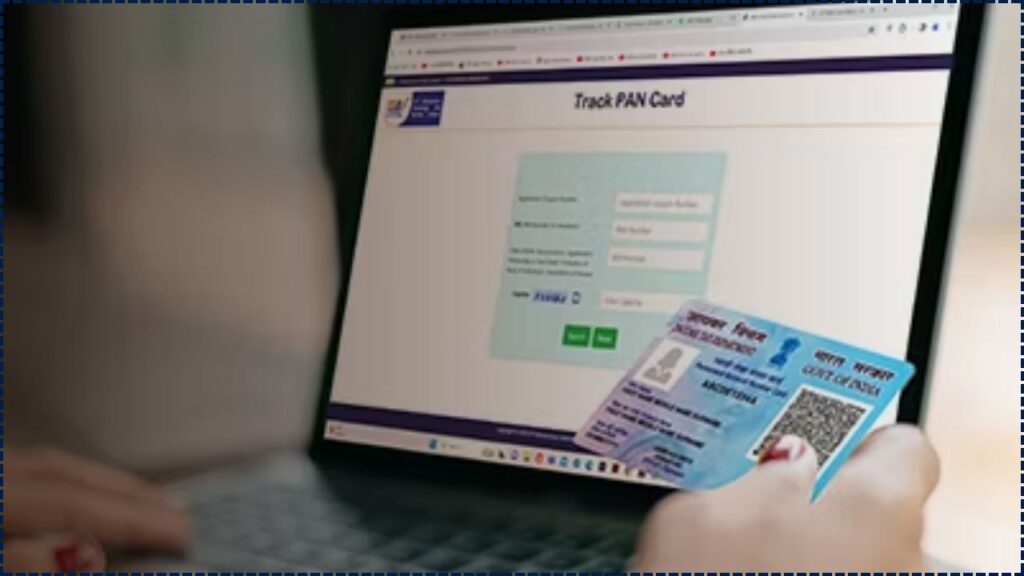

Tracking the Application

Applicants receive a 15-digit acknowledgement number after submission. This number can be used to check the application status online via NSDL, UTIITSL, or the Income Tax portal.

Receiving the PAN Card

- Digital PAN (e-PAN): Delivered to the applicant’s email, usually within 48 hours for Aadhaar-based applications.

- Physical PAN Card: Dispatched by post within 15–20 working days after successful verification.

Special Provisions

PAN for Minors

Applications for minors require the guardian’s identity and address proof. The minor’s photograph must also be submitted.

Instant e-PAN

Available only for Indian citizens with Aadhaar, free of cost. The card is issued digitally and carries the same legal validity as a physical PAN card.