The introduction of online applications for the National Savings Certificate (NSC) reflects India’s compassionate commitment to fostering financial inclusion and empowerment, particularly for urban and underserved communities, by providing a faster, safer, and more transparent digital pathway to secure savings opportunities that nurture hope and economic stability.

While traditional offline channels remain essential for rural investors, this digital initiative enhances accessibility, ensuring urban customers can engage with financial services with dignity and ease.

Experts’ advice to verify branch-level availability and maintain updated KYC records supports a smooth process, uniting investors, authorities, and communities in a shared mission to build an equitable, transparent financial ecosystem that empowers every individual to plan for a secure, prosperous future across India.

The National Savings Certificate (NSC), one of India’s most trusted government-backed small savings schemes, can now be applied for digitally through select banks and post office services. This step-by-step guide explains the complete online process.

What Is a National Savings Certificate?

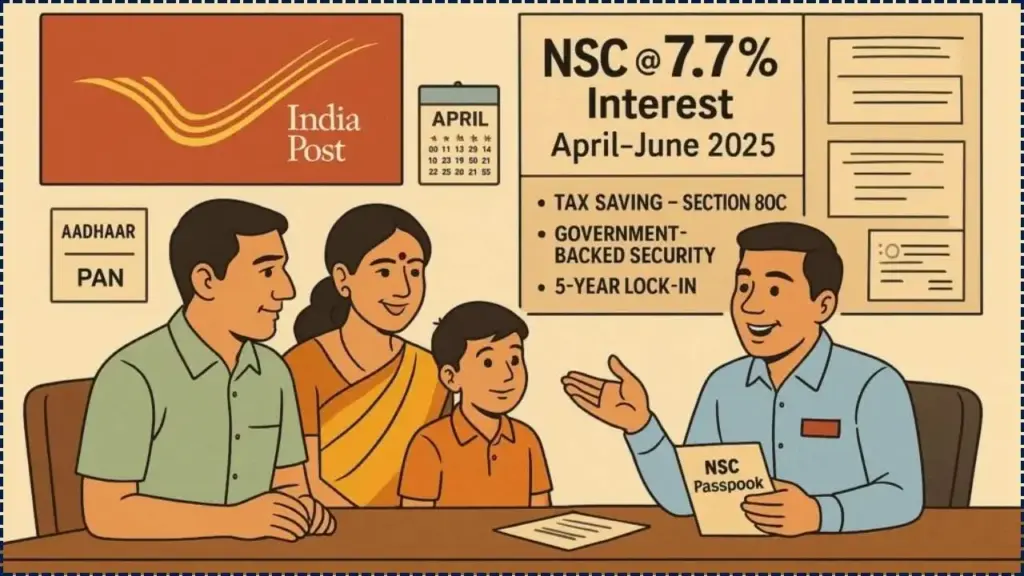

The National Savings Certificate is a fixed-income investment scheme under the Government of India, primarily targeted at small and middle-income savers. It offers a fixed rate of interest—currently 7.7% annually—with a maturity period of five years. NSC investments are eligible for tax benefits under Section 80C of the Income Tax Act, up to ₹1.5 lakh per year.

According to the Ministry of Finance, NSC is one of the flagship instruments aimed at encouraging household savings while offering a secure, government-guaranteed return.

Can You Apply for NSC Online?

While NSC has traditionally been sold through post offices, several banks and the India Post Payments Bank now allow customers to purchase NSCs online using internet banking or mobile applications.

However, experts note that availability varies by location and institution. “Some rural post offices still require physical visits for issuance, while urban branches increasingly support digital requests,” said a senior official at India Post during a 2024 press briefing.

Eligibility and Key Requirements

- Only Indian residents are eligible. Non-resident Indians (NRIs) are not permitted to invest.

- Minimum investment: ₹1,000. Further deposits must be in multiples of ₹100.

- Joint applications are allowed with another adult, and guardians may invest on behalf of minors.

- Investors must have valid KYC documents, including Aadhaar, PAN, and proof of address.

Guide to Applying for NSC Online

Check Availability

Confirm whether your bank or post office branch offers digital NSC services. Many major banks and India Post’s online portal now include this option.

Log in to Internet or Mobile Banking

Access your online banking account using secure credentials. Ensure your bank account is linked with Aadhaar and PAN for KYC compliance.

Navigate to NSC Services

Locate “Small Savings Schemes,” “Post Office Schemes,” or a direct “Open NSC” option in the service menu.

Enter Investment Details

Specify the amount (minimum ₹1,000), choose the account for payment, and add a nominee if required.

Review and Accept Terms

Carefully review the interest rate, lock-in period, and tax provisions before agreeing to the terms.

Make Payment

Authorize the transaction using your internet banking or UPI-linked account. Funds will be deducted instantly.

Obtain Confirmation

A digital acknowledgement or entry in your e-passbook will be generated. In some cases, a physical certificate must be collected from the post office.

Related Links

How to Apply for a Passport Reissue Online in India? Here’s Online Process

Checking PM Kisan Yojana Beneficiary Status Online: Check Online Process

Download Your Kisan Credit Card Statement Online Instantly: Check Easy Step-by-step Process

Benefits of the Online Application Process

- Convenience: Eliminates repeated post office visits.

- Transparency: Provides digital confirmation and easy access to records.

- Security: Backed by government guarantees and digital authentication protocols.

Limitations and Practical Challenges

Not all post office branches or banks currently support online NSC applications. Some applicants may still need to verify documents in person. Additionally, digital platforms can face service outages or delays during peak demand.

Financial planners advise investors to cross-check the availability of services at their local branch before relying entirely on online processes.

Current Interest Rates and Tax Benefits

As of September 2025, NSC investments offer an annual interest rate of 7.7%, compounded annually but payable at maturity. Investments are eligible for tax deductions under Section 80C, though interest earned (beyond reinvested portions) is taxable as per the investor’s income slab.